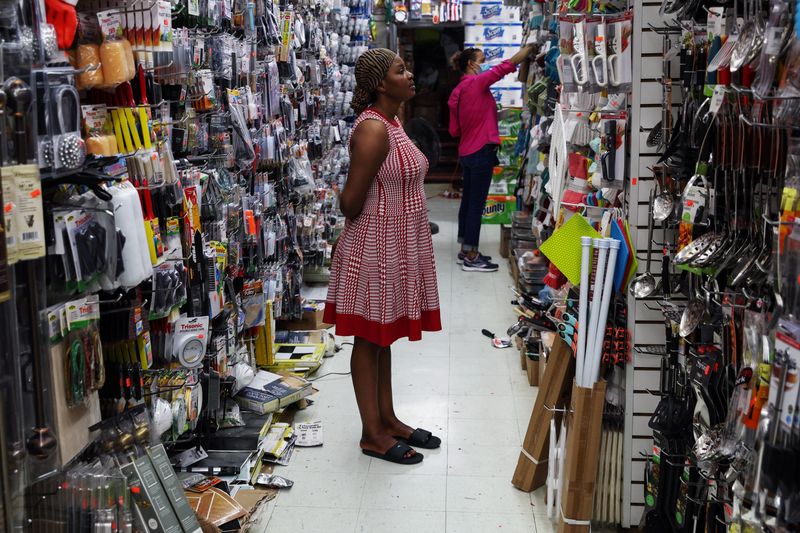

It’s a gut-wrenching reality check: Middle- and low-income U.S. families are now facing a significant depletion in their liquid resources, like bank deposits, compared to where they were headed before the seismic disruptions of the COVID-19 pandemic. This financial tightening is not just a personal issue—it threatens to squeeze consumer spending, the very lifeblood of our economy.

A recent report from the Federal Reserve Bank of San Francisco, released on Monday, paints a concerning picture. While the wealthiest 20% of households saw their liquid assets—cash, savings, and checking accounts—balloon during 2020 and early 2021, they’ve since seen a slight dip. These assets are now just 2% below what would have been expected if the pandemic hadn’t turned our world upside down.

But the situation is far more dire for the remaining 80% of American households. For them, the rise in liquid assets was modest, to begin with, and what little cushion they built up has evaporated faster than anyone anticipated. Today, these households are left with liquid assets that are a staggering 13% below the pre-pandemic trajectory. And that’s not the end of it—credit card delinquencies among these middle- and low-income families have surged earlier, faster, and to much higher levels than their wealthier counterparts.

Economists Hamza Abdelrahman, Luiz Edgard Oliveira, and Adam Shapiro have sounded the alarm: “Smaller financial cushions and heightened credit stress for households at the bottom 80% of the income distribution pose a risk to future consumer spending growth.”

Let’s be clear—consumer spending isn’t just a piece of the economic puzzle; it’s the cornerstone, accounting for roughly two-thirds of U.S. economic output. Despite the Federal Reserve’s aggressive interest rate hikes from 2022 to 2023, consumer spending and the labor market have held strong, defying expectations and fueling hope among policymakers that the economy could achieve the elusive “soft landing” where inflation is tamed without triggering a recession or massive job losses.

However, this optimistic narrative is beginning to fray. Recent data, including a troubling spike in the unemployment rate to 4.3%—the highest since the pandemic began—and a slowdown in hiring in July, are stoking fears that the Fed’s policy might be becoming too restrictive. The San Francisco Fed’s latest findings could add weight to these concerns, suggesting that the economy’s cracks are becoming harder to ignore.

Consumer spending, which contributed heavily to the surprisingly robust economic growth in the second quarter, is losing steam. Its monthly growth rate has slowed to an average of 0.3% in the three months through June—the weakest pace in over a year.

Chicago Fed President Austan Goolsbee recently pointed to the rise in credit card delinquencies as a potential red flag that monetary policy might be tightening more than necessary. Meanwhile, Fed Chair Jerome Powell has hinted that the central bank may start cutting rates as early as next month, as inflation shows signs of trending towards the Fed’s 2% target.

The question now is whether this move will come in time to prevent the tightening financial noose from choking off consumer spending, and with it, the broader economy. The stakes couldn’t be higher.