Asian Currencies Weaken as Traders Assess Trump Tariff Threats, Iran Unrest, and Fed Independence

Most Asian currencies moved lower on Tuesday, with the Japanese yen sliding to a one-year low, as higher oil prices driven by unrest in Iran weighed on the region. At the same time, new political and trade developments in the United States undermined investor confidence.

The U.S. Dollar Index, which tracks the dollar against a basket of major currencies, edged up 0.1% after posting a modest decline in the previous session. U.S. Dollar Index futures were also trading about 0.1% higher as of 03:36 GMT.

Yen Hits One-Year Low on Snap Election Speculation

The Japanese yen was the weakest performer in the region. The USD/JPY pair rose 0.4% to 158.76, marking its highest level since January 2025.

The currency came under pressure following reports that Japanese Prime Minister Sanae Takaichi may call a snap general election as early as February.

Market participants speculated that a potential election victory could give Takaichi a stronger mandate to pursue expansionary fiscal policies, adding further downward pressure on the yen.

Trump Tariff Threat, Iran Unrest, and Rising Oil Prices in Focus

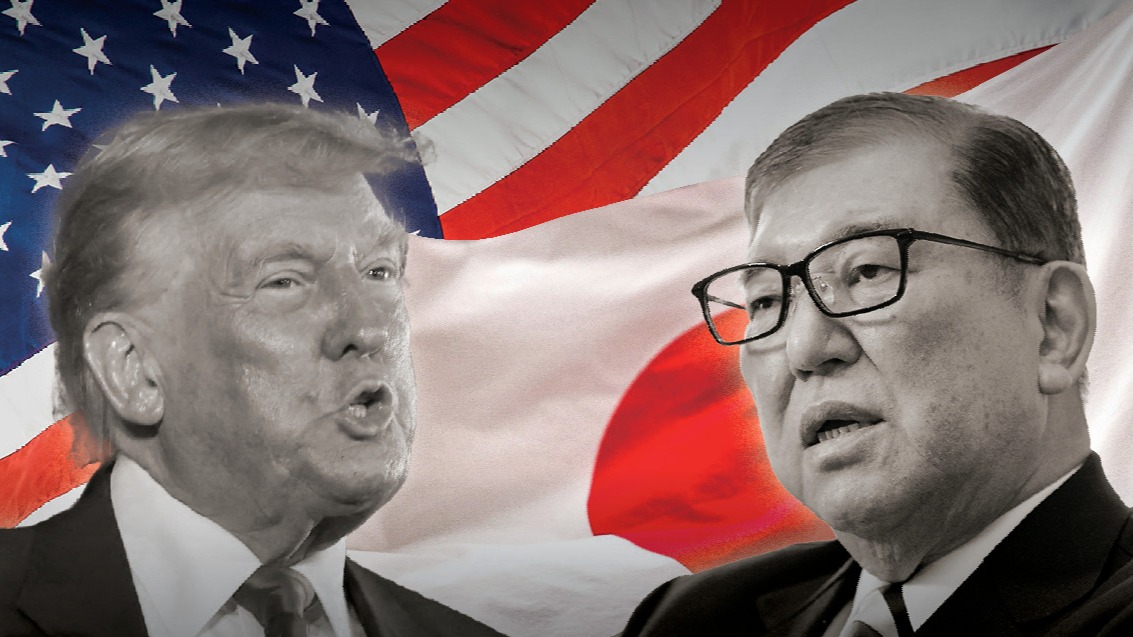

Risk sentiment across Asian markets remained fragile after U.S. President Donald Trump said Washington would impose a 25% tariff on goods from countries “doing business” with Iran, without offering details on the scope or timing of the measure.

Oil prices continued to rise after deadly anti-government protests in Iran heightened fears of supply disruptions. The unrest has also prompted warnings of possible military action from Trump, increasing geopolitical risk premiums.

Analysts noted that Asian currencies may have been negatively affected by recent gains in oil prices, pointing to developments not only in Iran but also in Venezuela. They added that, beyond China, countries such as Turkey, the United Arab Emirates, and to a lesser extent Russia and India maintain trade links with Iran, increasing their exposure.

Elsewhere in Asia, the South Korean won weakened further, with the USD/KRW pair rising 0.4% for a seventh consecutive session.

The Indian rupee also slipped, with USD/INR edging up 0.1%, while the Singapore dollar traded flat against the U.S. dollar.

In China, the onshore yuan pair USD/CNY was little changed, while the offshore pair USD/CNH ticked 0.1% higher. The Australian dollar also traded largely unchanged against the greenback.

Fed Independence Concerns Fuel Risk-Off Mood

Investor sentiment was further weighed down after the Trump administration opened a criminal investigation into Federal Reserve Chair Jerome Powell related to his testimony on renovation work at the central bank’s headquarters. The move reignited concerns over the independence of the Federal Reserve.

In a statement, Powell defended the Fed’s autonomy, saying that policy decisions would continue to be guided solely by economic data and the central bank’s mandate. Several former Federal Reserve chairs and senior officials publicly expressed support for Powell.

Market observers said investors have shifted into a wait-and-see stance as they attempt to assess the broader implications of these developments.

Despite the recent softness in the U.S. dollar, Asian currencies struggled to benefit, as investors remained focused on wider risks stemming from U.S. political uncertainty, trade tensions, and rising oil prices. Attention is now turning to upcoming U.S. economic data and signals from the Federal Reserve, as traders reassess interest rate expectations amid increasing political pressure on the central bank.